Stress Testing

Chaston offers Stress Testing for all or a portion of client portfolios. Data is collected to assess current cash flow and collateral values. A multi-factored approach is then taken to stress current economic considerations to see how they could potentially affect the commercial portfolio.

This includes the impact of:

-

Escalating interest rates on cash flow

-

Deterioration of income and increasing expenses on repayment

-

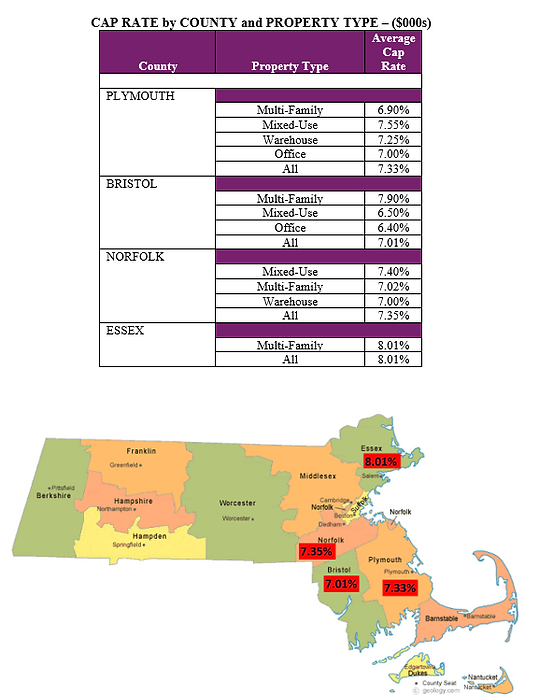

The change in value of real property as a result of capitalization rate increases

Stress Testing deliverables include a comprehensive report detailing existing and potential scenarios, what may cause them, and their impact on the client portfolio, as well as an interactive workbook that the client can utilize to further manipulate stress factors. Chaston’s report considers the impact of each scenario on Tier 1 Capital and other useful metrics for strategic planning.